Calculate the costs of buying versus leasing a motor vehicle – Calculating the costs of buying versus leasing a motor vehicle is a crucial decision that requires careful consideration. This guide provides an in-depth analysis of the financial, lifestyle, and long-term implications of each option, empowering individuals to make an informed choice that aligns with their specific needs and circumstances.

Understanding the different costs associated with buying and leasing, such as upfront payments, monthly payments, and long-term expenses, is essential for making a sound decision. Factors like the type of vehicle, mileage, lease term, and interest rates significantly influence the overall cost of ownership.

Overview of Costs: Calculate The Costs Of Buying Versus Leasing A Motor Vehicle

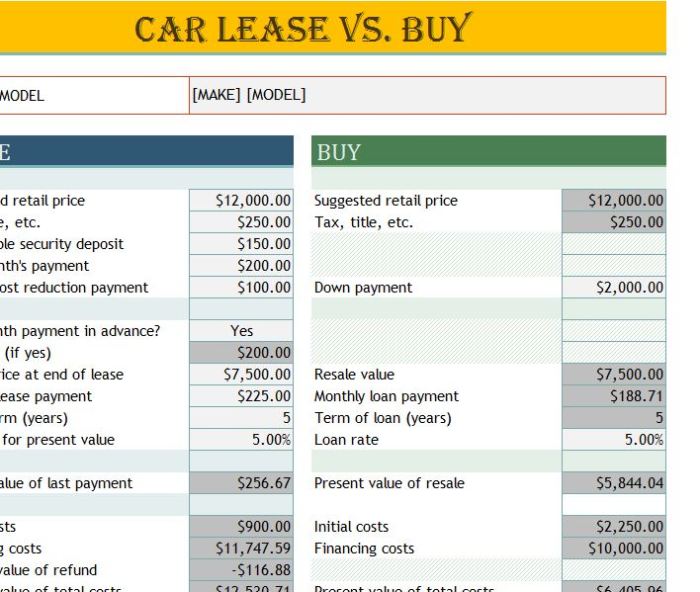

Buying and leasing a motor vehicle involve different cost considerations. Upfront costs for buying include the purchase price, taxes, and registration fees. Monthly payments consist of loan payments, insurance, and maintenance. Long-term expenses encompass repairs, depreciation, and potential resale value.

| Cost Category | Buying | Leasing |

|---|---|---|

| Upfront Costs | Purchase Price, Taxes, Registration Fees | Down Payment, Lease Acquisition Fee |

| Monthly Payments | Loan Payments, Insurance, Maintenance | Lease Payments, Insurance, Maintenance |

| Long-Term Expenses | Repairs, Depreciation, Resale Value | Lease End Buyout Option, Disposition Fee |

Factors Influencing Costs

Several factors affect the cost of buying or leasing a motor vehicle:

- Type of Vehicle:Luxury vehicles, SUVs, and trucks typically have higher costs than sedans and hatchbacks.

- Mileage:Higher mileage vehicles generally have lower resale value and higher maintenance costs.

- Term of Lease:Longer lease terms result in lower monthly payments but higher overall costs.

- Interest Rates:Interest rates on loans and leases can vary, impacting monthly payments and overall costs.

Financial Considerations

Buying and leasing have different financial implications:

- Impact on Credit Score:Buying a vehicle typically improves credit scores, while leasing may have less impact.

- Tax Implications:Sales tax is paid upfront when buying a vehicle, while lease payments are subject to sales tax.

- Resale Value:The resale value of a purchased vehicle depends on factors like mileage, condition, and market demand.

Lifestyle Considerations

Lifestyle factors influence the decision between buying and leasing:

- Driving Habits:Individuals who drive high mileage may prefer buying a vehicle for lower long-term costs.

- Need for Flexibility:Leasing offers flexibility in terms of lease terms and vehicle upgrades.

- Personal Preferences:Some individuals prefer the ownership and customization options associated with buying, while others value the convenience and flexibility of leasing.

Long-Term Ownership Costs

Long-term ownership costs include expenses beyond the initial purchase or lease payments:

- Maintenance and Repairs:Buying a vehicle requires regular maintenance and repairs, which can be significant over time.

- Insurance:Insurance premiums vary based on factors like the vehicle’s value, driver’s history, and coverage levels.

- Depreciation:Vehicles depreciate in value over time, which can affect the resale value when selling.

Decision-Making Process

To make an informed decision, consider the following steps:

- Determine your financial situation and budget.

- Research different vehicles and compare costs.

- Consider your lifestyle factors and driving habits.

- Negotiate the best terms with dealers or lessors.

- Evaluate the long-term implications of buying or leasing.

FAQ Guide

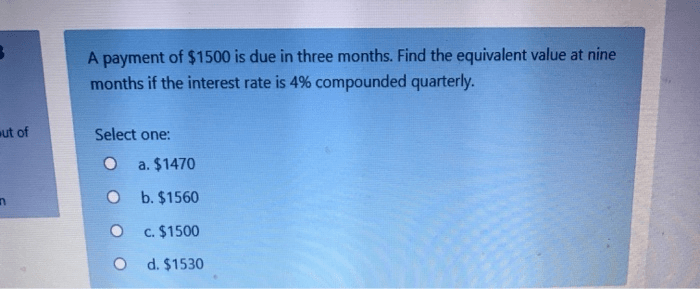

What are the main differences between buying and leasing a motor vehicle?

When buying a vehicle, you own it outright and are responsible for all costs associated with ownership, including maintenance, repairs, and depreciation. Leasing, on the other hand, involves renting a vehicle for a predetermined period, typically two to four years, with monthly payments covering depreciation, maintenance, and repairs.

Which option is more financially beneficial in the long run?

In most cases, buying a vehicle is more financially beneficial in the long run, as you eventually own the vehicle and have the potential to build equity. Leasing can be a more cost-effective option in the short term, but you will not own the vehicle at the end of the lease term.

What factors should I consider when making a decision?

Factors to consider include your driving habits, financial situation, lifestyle, and long-term goals. If you drive a lot or plan to keep the vehicle for a long time, buying may be a better option. If you prefer flexibility, lower monthly payments, or want to drive a newer vehicle every few years, leasing may be a better choice.